JBA TIBOR Reform

Updated on June 3, 2025

This page outlines our efforts related to the "First Phase of JBA TIBOR Reform" which was implemented in July 2017 to enhance the transparency, robustness, and reliability of JBA TIBOR and the subsequent "Second Phase of JBA TIBOR Reform" which had been implemented with the aim of further enhancing the robustness.

JBA TIBOR Reform

First Phase of JBA TIBOR Reform

In light of the investigations and enforcement actions regarding attempted manipulation of LIBOR in 2012, the International Organization of Securities Commissions ("IOSCO"), which comprises the securities and financial market regulators from around the world, published the Final Report on Principles for Financial Benchmarks (commonly known as the "IOSCO Principles") in July 2013 and required administrators of major interest rate benchmarks (e.g. LIBOR, TIBOR) to comply with the 19 Principles.

In July 2014, the Financial Stability Board ("FSB") released "Reforming Major Interest Rate Benchmarks", recommending that it should be necessary to create a mechanism that eliminates ,as far as possible, the arbitrary judgment by reference banks and to reform benchmarks to enhance their transparency, robustness, and reliability.

Based on these international requirements and recommendations, the General Incorporated Association JBA TIBOR Administration ("JBATA"), established in April 2014, implemented the "First Phase of JBA TIBOR Reform" in July 2017 after three rounds of public consultations. One of the key concepts of this reform was to standardize and clarify the calculation/determination processes of submission rates so as to make JBA TIBOR more anchored in actual transactions.

Second Phase of JBA TIBOR Reform

JBATA refers to the initiatives following the First phase of JBA TIBOR Reform as the "Second Phase of JBA TIBOR Reform". which aims to further enhance the robustness of JBA TIBOR by resolving certain issues related to IOSCO Principles 7 and 13.

In December 2024, JBATA permanently ceased the publication of all tenors (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) of Euroyen TIBOR. The final publication date was Monday, December 30, 2024.

Key points of JBATA's efforts taken to date are as summarized below.

[October 2018] (Public consultation on the approach for integrating Japanese Yen TIBOR and Euroyen TIBOR)

○ In consideration of prolonged downsizing of the underlying markets, JBATA consulted on the approach for integrating Japanese yen TIBOR and Euroyen TIBOR.

[May 2019] (The option to discontinue Euroyen TIBOR gained the most support.)

○ Given that "retaining Japanese yen TIBOR and discontinuing Euroyen TIBOR" was the most supported option as a result of the above consultation, the following two points were announced.

(i)Assuming this option as the most likely option, JBATA will devise the specifics of the reforms while paying attention to developments in the financial markets and ongoing domestic and international policy discussions, such as the cessation of LIBOR.

(ii) The JBATA envisions a preparation period of approximately two years following the permanent cessation of LIBOR.

[March 2021] (Announcement of the expected timing of Euroyen TIBOR discontinuation, if implemented)

○ Based on a statement issued by the regulator of LIBOR regarding the future permanent cessation or loss of representativeness of LIBOR, JBATA announced that the expected timing of discontinuing Euroyen TIBOR, if implemented, would be at the end of December 2024. It also announced that it would take actions to discuss fallback issues.

[August 2022] (Public Consultation on fallback issues for JBA TIBOR)

○ JBATA consulted on fallback issues for JBA TIBOR.

[March 2023] (Results of Public Consultation on fallback issues for JBA TIBOR)

○ Based on responses from 11 respondents, JBATA described its position on fallback issues (i.e. triggers, benchmark replacement) for JBA TIBOR and its views on the introduction of fallback provisions in contracts referencing JBA TIBOR.

○ In addition, it was mentioned that JBATA intends to publish another consultation on whether to permanently cease to publish Euroyen TIBOR in the first half of the fiscal year ending March 31, 2024, while its results are expected to be published in the second half of the fiscal year.

[August 2023] (Public Consultation on permanent cessation of Euroyen TIBOR and related issues)

○ JBATA consulted on permanent cessation of Euroyen TIBOR and related issues.

[December 2023](Comments on the "timing to cease entering into new contracts" for products referencing Euroyen TIBOR)

○ In light of the comments to above Public Consultation, JBATA published a document describing the comments received regarding the timing to cease entering into new contracts for cash products (loans and bonds) and interest rate swaps referencing Euroyen TIBOR in advance of publishing the result of Public Consultation.

[March 2024](Statement on future cessation of Euroyen TIBOR)

○ JBATA published the Results of Public Consultation and a statement announcing that "the publication of all tenors (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) of Euroyen TIBOR will permanently cease immediately after the end of December 2024."

[December 2024] (Permanent cessation of Euroyen TIBOR)<br />○ JBATA permanently ceased the publication of all tenors (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) of Euroyen TIBOR. The final publication date was Monday, December 30, 2024.

Reporting on compliance with the IOSCO Principles

Pursuant to Article 2(2) of the JBA TIBOR Operational Rules, JBATA reviews the status of compliance with the IOSCO Principles and discloses its overview on an annual basis (see the link below for details).

JBATA has evaluated that compliance with the IOSCO Principles has been achieved through the First Phase of JBA TIBOR Reform. Following the First Phase of JBA TIBOR Reform, JBATA engaged in further initiatives to resolve some remaining issues recognized for IOSCO Principle 7 (Data Sufficiency) and Principle 13 (Transition) with the aim of enhancing the transparency, robustness, and reliability of JBA TIBOR. As a result of our efforts, we have assessed that "There are no additional issues to be addressed under the Principles" in the JBA TIBOR operational framework.

| IOSCO Principles | Current Status |

|---|---|

| Principle 13 Transition Administrators should have clear written policies and procedures, to address the need for possible cessation of a Benchmark. Administrators' written policies and procedures to address the possibility of Benchmark cessation could include criteria to guide the selection of a credible, alternative Benchmark and other factors, if determined to be reasonable and appropriate by the Administrator. |

<Fully Complied> ・ JBATA developed the process and policy for the transition to alternative benchmarks ("fallback rates") in March 2020. |

| Principle 7 Data Sufficiency The data used to construct a Benchmark determination should be sufficient to accurately and reliably represent the Interest measured by the Benchmark. |

<Fully Complied> ・The publication of all tenors of Euroyen TIBOR permanently ceased at the end of December 2024, due to the fact that the low proportion of submission rates of Euroyen TIBOR determined by using data of the underlying market (i.e. the Japan Offshore Market), as well as the long-term shrinkage of the Japan Offshore Market compared to the Japan unsecured call market (i.e. the underlying market of Japanese Yen TIBOR). |

Survey on JBA TIBOR Exposures

As part of the "Second Phase of JBA TIBOR Reform," JBATA conducted "Survey on JBA TIBOR Exposures" (reference date: End-2021), covering a wide range of financial institutions, including banks, securities companies and insurance companies, with a view to understanding the actual conditions of financial instruments and transactions referencing JBA TIBOR and reflecting the usage status into the future discussions.

Key results of the survey are summarized in the table below.

The amounts outstanding of contracts referencing Japanese Yen TIBOR are 119.8 trillion yen of Loans, 400 billion yen of Bonds, and 180.4 trillion yen of notional amounts of Derivatives.

For details, please see "Key Results of the Survey on JBA TIBOR Exposures".

| Japanese Yen TIBOR | (Reference) Euroyen TIBOR | |||

|---|---|---|---|---|

| Amount outstanding | Number of contracts | Amount outstanding | Number of contracts | |

| Loans | 119.8 | 290.8 | 3.8 | 2.7 |

| Bonds (Liabilities) | 0.4 | 0.1 | 0.004 | 0.01 |

| Derivatives | 180.4 | 47.2 | 347.7 | 30.7 |

* Amount outstanding (or notional amount in the case of Derivatives): in trillions of yen, Number of contracts: in thousands

Position paper (June 2025)

For market participants and TIBOR users, JBATA has published a position paper and its explanatory document, which summarize our view on the current status and outlook of JBA TIBOR.

○ Position paper and its Explanatory document

Public consultation on fallback issues

In August 2022, JBATA released the "Public Consultation on fallback issues for JBA TIBOR."

○ Public Consultation on fallback issues for JBA TIBOR

JBATA undertook this public consultation to seek to solicit comments from a wide range of market participants on fallback issues for cash products (loans and bonds) referencing JBA TIBOR as below (consultation period: September 30, 2022).

In March 2023, JBATA released the "Results of Public Consultation on fallback issues for JBA TIBOR"

○ Results of Public Consultation on fallback issues for JBA TIBOR

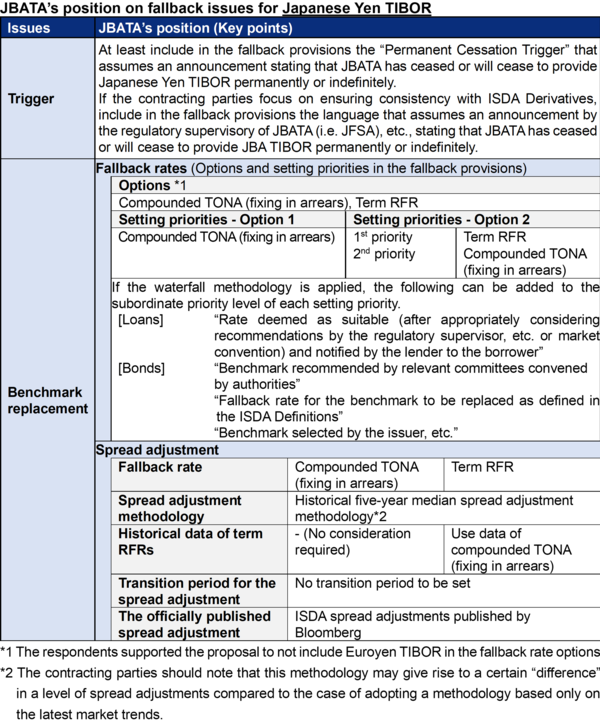

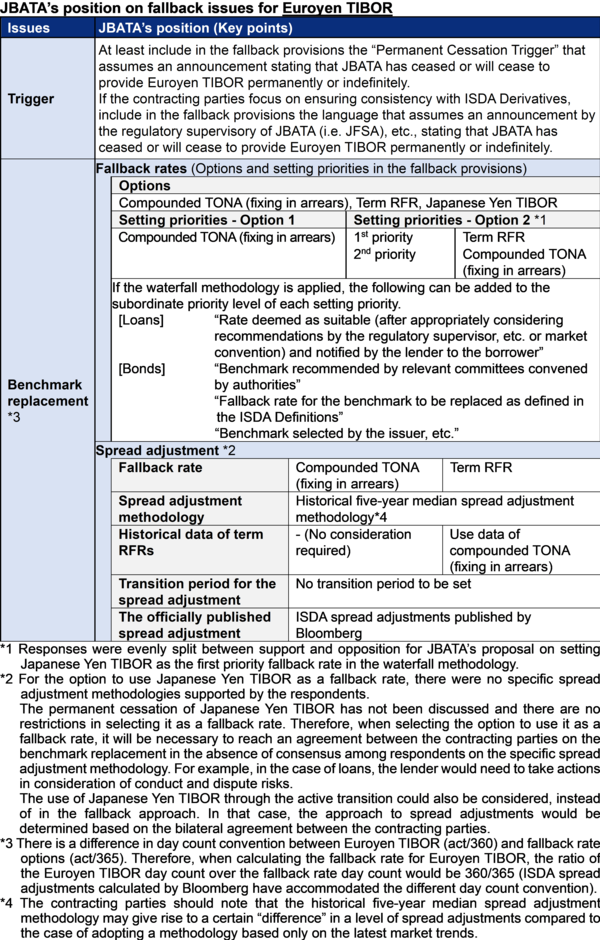

Based on responses from 11 respondents, JBATA summarizes its positions on respective fallback issues as follows.

*JBATA's position will not have any binding effects on individual contracts referencing JBA TIBOR, and JBATA does not recommend any particular rates and methodologies. In addition, it does not intend to preclude the contracting parties from reaching an agreement on the terms and conditions other than its positions.

Additionally, the views on the introduction of fallback provisions in contracts referencing JBA TIBOR are as provided below for each benchmark based on the comments received for the "Public Consultation on fallback issues for JBA TIBOR".

<Introduction of fallback provisions for contracts referencing Euroyen TIBOR>

Given that the permanent cessation at the end of December 2024 is under consideration for Euroyen TIBOR, its users should promptly consider, as an option, the introduction of fallback provisions for Euroyen TIBOR contracts that will mature after the end of December 2024.

<Introduction of fallback provisions for contracts referencing Japanese Yen TIBOR>

While the permanent cessation of Japanese Yen TIBOR has not been discussed, its users should consider the introduction of fallback provisions for those contracts referencing Japanese Yen TIBOR from the perspective of enhancing the stability and robustness of contracts.

However, given some feedback which raised a concern about operational burdens for incorporation of fallback provisions into a large amount outstanding and number of contracts referencing Japanese Yen TIBOR, we also consider that its users take a practicable approach such as starting first from "new" Japanese Yen TIBOR contracts.

In the "Publication of Results of Public Consultation on Fallback Issues for JBA TIBOR by JBA TIBOR Administration" published by Financial Services Agency (JFSA) in March 2023, it was mentioned that JFSA "expects the introduction of fallback provisions into contracts referencing JBA TIBOR to be advanced based on the Results of the Public Consultation and will support these efforts as needed" in accordance with our views described above.

Public consultation on permanent cessation of Euroyen TIBOR and related issues

In August 2023, JBATA released the "Public Consultation on permanent cessation of Euroyen TIBOR and related issues."

○ Public Consultation on permanent cessation of Euroyen TIBOR and related issues(Consultation period:September 30, 2023)

JBATA undertook this public consultation to seek to solicit comments from a wide range of market participants on whether to permanently cease Euroyen TIBOR which was deemed as the most likely option and its timing, if adopted.

As a practical issue related to the permanent cessation of Euroyen TIBOR, the public consultation also seeks comments on the timing to cease entering into new contracts for cash products (loans and bonds) and interest rate swaps referencing Euroyen TIBOR.

In December 2023, JBATA published the Comments on the "timing to cease entering into new contracts" for products referencing Euroyen TIBOR in advance of publishing the result of Public Consultation.

After that, JFSA issued the announcement in response to the JBATA's publication.

|

(Excerpt from JFSA's announcement) If the permanent cessation of Euroyen TIBOR is determined to be implemented at the end of December 2024, the Financial Services Agency (FSA) expects the orderly transition away from the benchmark to be realized. In order to support such a smooth transition, based on the majority view of the respondents to the Public Consultation, the FSA suggests that market participants cease entering into new contracts for products referencing Euroyen TIBOR by the end of June 2024 at the latest.* * It does not preclude derivatives transactions such as those intended for risk management of existing positions. In addition, it does not preclude financial institutions from executing those transactions for customers which would result in increasing Euroyen TIBOR exposure, and does not require financial institutions to confirm their customers' purposes of trade before and after selling financial instruments or executing transactions. |

○ Comments on the "timing to cease entering into new contracts" for products referencing Euroyen TIBOR

In March 2024, JBATA published a statement announcing that "the publication of all tenors (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) of Euroyen TIBOR will permanently cease immediately after the end of December 2024," given the Results of Public Consultation and the Survey on Euroyen TIBOR Exposures.

In consideration of JBATA's publication, JFSA and ISDA issued the announcement/statement as below URLs.

○ ISDA Statement on JBATA's Euroyen TIBOR Announcement(ISDA)

In addition, Bloomberg Index Services Limited ("Bloomberg") published the following spread adjustment values for fallback of derivatives transactions that reference Euroyen TIBOR, based on the ISDA's determination.

〇 IBOR Fallbacks:Spread Fixing Event for JPY Euroyen TIBOR

As stated in "JBATA's position on fallback issues for Euroyen TIBOR" above, we have already presented our position that it would be preferable to use spread adjustment values published by Bloomberg for cash products (loans and bonds).

Permanent cessation of Euroyen TIBOR (The final publication date was December 30, 2024)

As of March 6, 2024, JBATA announced that the publication of all tenors (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) of Euroyen TIBOR would permanently cease immediately after the end of December 2024.

Subsequently, all tenors of Euroyen TIBOR (i.e. 1-week, 1-month, 3-month, 6-month, and 12-month) permanently ceased as planned. The final publication date was December 30, 2024.

Please note that there is no successor administrator that continues to provide Euroyen TIBOR and that we do not publish so-called "synthetic Euroyen TIBOR" after the cessation of Euroyen TIBOR.

If you would like to check the historical Euroyen TIBOR rates, please click on the following link.

JBATIBOR rates (Historical records)